A group of Christian church investors is planning to put pressure on companies which have no women directors or a questionable record on tax.

The Church Investors Group has pension fund members with £21bn in assets.

It says it will vote against chairmen and women of boards of big companies which have poor polices on tax transparency and climate change.

It will also vote against pay reports which do not disclose the ratio of pay between top bosses and workers.

The Church Investors Group (CIG) has 67 members including the pension funds for the Church of England and the Methodist Church.

'Common good'

"Ultimately a company's license to operate depends on the confidence of the public and its long-term contribution to the common good," said Canon Edward Carter, chair of CIG.

"As asset owners, we will continue to press with our votes the need for companies to act responsibly and work not only for the benefit of shareholders, but also contribute to the wider common good in both the short and long term," he said.

CIG says it has told FTSE 350 companies - the largest companies publicly traded in London - of its plans.

It will also include Russell 50 companies - an index of the biggest US companies - when it comes to tax transparency.

Large companies will soon have their annual meetings where shareholders will be called to vote on board membership, pay for top executives and to accept annual results.

'Hard line'

The CIG says its members will vote against the chairs of FTSE 350 and Russell 50 companies with a score of zero for tax transparency in the FTSE ESG ratings, which look at environmental, social and governance matters.

Currently, that includes Exxon, Amazon and Broadcom, the Financial Times reported.

The CIG also said it wanted to "take a hard line on excessive executive remuneration" and that it "continues to have concerns about CEOs receiving pension payments that are more generous than those made to other staff".

The Church of England has a £8.3bn investment fund, which it says it invests in an "ethical and responsible way".

The Church holds investments in firms including pharmaceutical giant GlaxoSmithKline, the bank HSBC, supermarket Tesco, as well as tech firms Microsoft and Samsung.

However, it has been criticised for some of its investments.

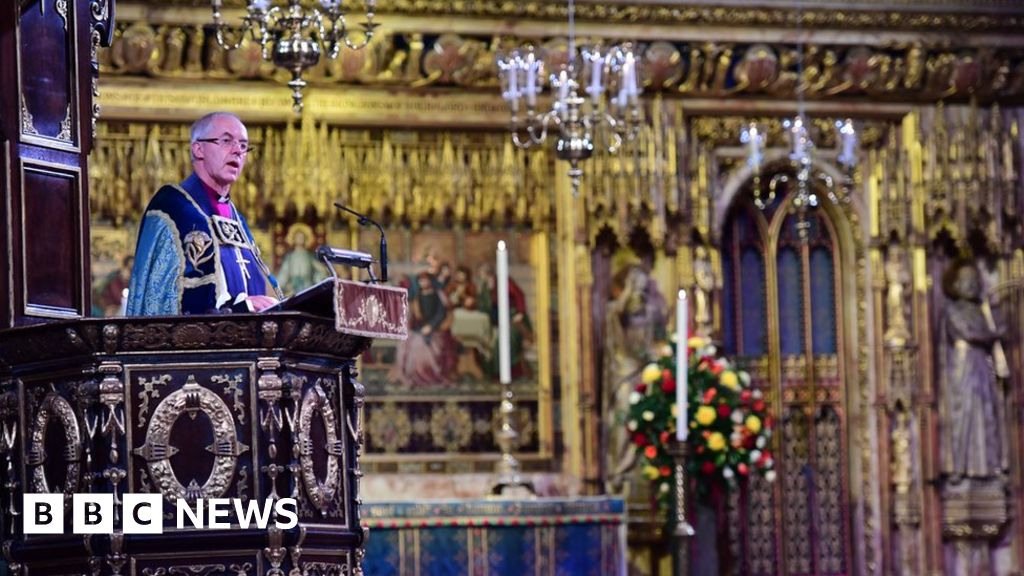

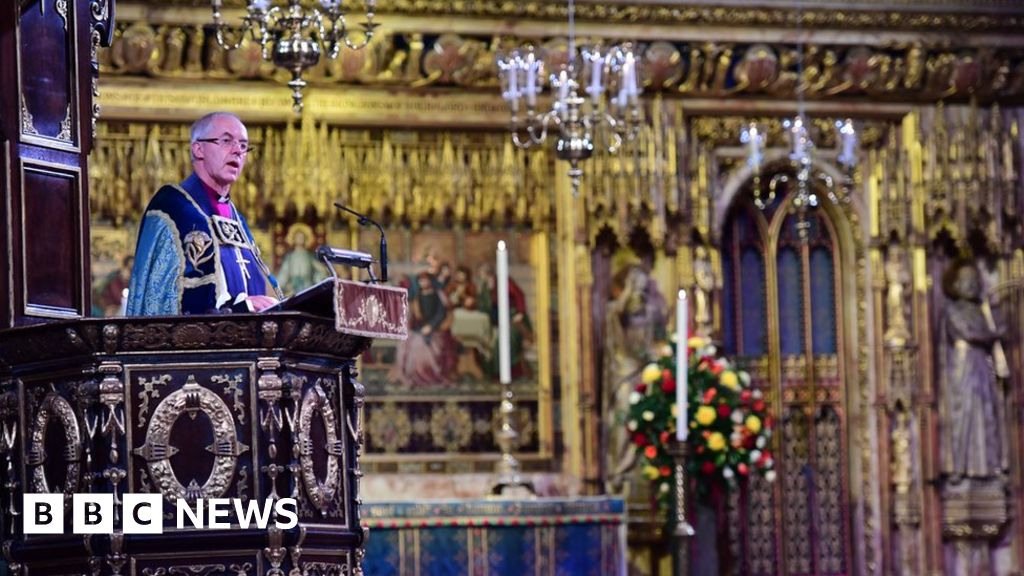

In September, the Church said it was keeping its shares in Amazon - a day after the Archbishop of Canterbury Justin Welby said the firm was "leeching off the taxpayer".

The archbishop had questioned Amazon's tax record.

In 2014, the commissioners sold around £75,000 of shares in failed payday lender Wonga after the archbishop pledged to "put it out of business".

He had admitted to being "embarrassed" and "irritated" when details of the link emerged in 2013.

No comments:

Post a Comment

Many thanks for your comment! We look forward to hearing from you again.

In the meantime why not get involved with Adodo Community! You could give 1% of your total telecom spend to a school, charity or community project of your choice!