-

PHONE SYSTEMS

World class phone systems to help increase productivity.

-

FIXED LINES

Large portfolio of services to help manage your spend.

-

MOBILE

Comprehensive mobile phone solutions to assist with your flexibility.

-

DATA

Data and broadband solutions to improve your flow of information.

-

COMMUNITY

We're adding value by giving back to your community.

Friday 29 May 2020

Adodo Consultancy Services Limited

“Weekends don’t count

unless you spend them doing something completely pointless.” -Bill Watterson

#weekends #makeitcount

Thursday 28 May 2020

Adodo Consultancy Services Limited

The owner of Giraffe and Ed's Easy Diner is to close 27 restaurants putting hundreds of jobs at risk.

The brands will enter a company voluntary arrangement (CVA) and close almost a third of their 87 restaurants.

Boparan Restaurant Group (BRG) said sales had improved at the chains since they were acquired in 2016, but several sites remained unprofitable.

Tom Crowley, chief executive of BRG, said: "The CVA is the only option to protect the company."

He added: "The combination of increasing costs and over-supply of restaurants in the sector and a softening of consumer demand have all contributed to the challenges both these brands face."

The proposal to enter a CVA will be put to a creditor vote, with advisers from KPMG overseeing the insolvency process.

BRG snapped up Giraffe from Tesco in 2016, before combining it with Ed's Easy Diner, which it had bought in a pre-pack administration the same year.

The two brands form a combined entity, which in the most recently available accounts had annual turnover of £67.1m with underlying losses of £1.6m.

The company owns 70 branches of the two chains, with 17 franchised restaurants unaffected by the CVA.

Will Wright, restructuring partner at KPMG, said: "This CVA seeks to address the cost of the company's leasehold obligations across a number of unprofitable sites, and if successful, will put the business on a surer financial footing."

Creditors will vote on the proposal on 21 March with at least 75% needed to approve it for the CVA to proceed.

BRG also owns other brands, which are not involved in this CVA. These include fish and chip restaurant Harry Ramsden and the upmarket Cinnamon Collection.

It is also the master franchisee for US brand Slim Chickens, which first opened in the UK last year.

BRG is owned by "chicken king" Ranjit Boparan, who also owns the 2 Sister group, which supplies food to supermarkets such as Aldi, Asda, Co-op, KFC, Lidl, Marks & Spencer, Morrisons, Sainsbury's, Tesco and Waitrose.

Last year, rising costs and tougher competition led to several restaurant brands shutting branches, including Prezzo, Jamie's Italian, Byron, Carluccio's, Gaucho and Gourmet Burger Kitchen.

Adodo Consultancy Services Limited

How can small business owners build community with social media? Check out this read: https://bit.ly/3etg2Oy #smallbusiness #socialmediamarketing #socialmarketing

Wednesday 27 May 2020

Adodo Consultancy Services Limited

Why waste time on digital marketing when you're so much better at sales, managing, and running your business? Take a look at why outsourcing your digital marketing to places like Adodo Consultancy Services Limited may truly be in your best interest. http://b2c.news/1HL7kp

Adodo Consultancy Services Limited

Social Media Marketing

Industry ReportIn our 10th annual social media study (44 pages, 70+ charts) of 5700+ marketers, you'll discover which social networks marketers most plan on using, organic social activities, paid social media plans, and much more! Get this free report and never miss another great article from Social Media Examiner.

Tuesday 26 May 2020

Adodo Consultancy Services Limited

"Life begins at the end of your comfort zone." - Neale Donald Walsh

Adodo Consultancy Services Limited

Some car buyers are being overcharged by more than £1,000 when they take out a loan to buy a car, the UK's financial watchdog has warned.

The Financial Conduct Authority (FCA) said the industry practice of allowing dealers to set their own interest rates was costing consumers £300m a year.

Dealers overcharge to boost their commission, the FCA concluded.

But the Finance and Leasing Association said the watchdog's survey was "based largely on out-of-date information".

Conflicts of interest

The regulator launched its investigation into the car finance market in April 2017 after there was a rapid surge in consumer credit led by car dealership finance.

At the time, it said it was concerned about a lack of transparency and potential conflicts of interest.

In its final findings on motor finance, the FCA concluded that the widespread use of commission models, which allow brokers discretion to set the customer's interest rate and thus earn higher commission, can lead to conflicts of interest that are not controlled adequately by lenders.

It said the practice can lead to customers paying significantly more for their motor finance.

Jonathan Davidson of the FCA said: "We found that some motor dealers are overcharging unsuspecting customers over a thousand pounds in interest charges in order to obtain bigger commission payouts for themselves.

"We also have concerns that firms may be failing to meet their existing obligations in relation to pre-contract disclosure and explanations, and affordability assessments.

"This is simply not good enough and we expect firms to review their operations to address our concerns."

Problem finance?

Four-fifths of new car finance deals are now what are known as Personal Contract Purchase, or PCP.

Instead of buying a car outright, a PCP allows consumers to rent a car over a three or four-year period.

At the end of the period consumers can buy the car for its residual value (known as a "balloon" payment), hand the car back, or roll over the residual value into a new PCP on a new vehicle.

But problems have arisen because lenders have allowed brokers to set interest rates on the PCP agreements.

The FCA estimated that on a typical motor finance agreement of £10,000, higher broker commission can result in the customer paying around £1,100 more in interest charges over a four-year term of an agreement.

'Considerable progress'

The FCA said it was assessing the options for intervening in the market.

Options include strengthening existing rules or other steps such as banning certain types of commission model or limiting broker discretion.

In the meantime, the regulator said it would deal with individual firms where problems were identified, but it expects all lenders and brokers to review the way they do business to make sure they comply with the law and treat customers fairly.

The Finance and Leasing Association (FLA), a UK trade body for asset finance, consumer finance and motor finance, said that the FCA's survey work was "based largely on out-of-date information, and therefore does not reflect the very considerable progress the market has already made in moving away from such structures".

The FCA analysed contracts between lenders and dealers from 2013 to 2016 and examined lenders' data from January 2017 to July 2018.

The FLA added: "We look forward to working with the FCA as it modernises its regulations in line with market best practice."

Monday 25 May 2020

Adodo Consultancy Services Limited

Now is the perfect time to start something new! Dream Big! Make this week worthwhile. #mondaymotivation #dreambig #startsomethingnew

Adodo Consultancy Services Limited

Is your Sales Process mainly manual or is it push button automation? Here are 5 ideas. https://clik.site/AI-in-sales/ #salesautomation #askadodo #ai

Sunday 24 May 2020

Adodo Consultancy Services Limited

Social media does, in fact, help get the word out about your business. But even more important than the exposure, it provides you with the opportunity to grow relationships with your target audience. Let Adodo Consultancy Services Limited help you with your social media strategy. Visit us at https://adodo.co.uk #socialmediamarketing #socialmediastrategy

Adodo Consultancy Services Limited

A single mother herself, this contributor starts out with the tip, 'You're not alone.'

March 1, 2019 7 min read

Opinions expressed by Entrepreneur contributors are their own.

Some years ago, early in my career, I was just starting a demanding new job when I had a conversation with my then-boss that is forever etched onto my brain. My son was 6 at the time, and I thought it best to proactively mention that in the case of an illness or emergency, I might need to leave work early to tend to him.

Related: How a Rude Boss Can Hamper Your Parenting Style

I had had my son in my fourth year of college at UCLA and was a young, single mother trying to juggle many responsibilities while providing for my child.

Though I see now that there was no reason to disclose this fact to my leadership -- I should have had every right to take care of my child when necessary -- I thought at the time that I was doing the right thing, being transparent. Unfortunately, my boss’s reaction was jarring.

“Why didn’t you tell me you had a son?” was the curt, annoyed reply. This person was visibly flustered that I had a personal obligation that might, on occasion, distract me from my work. And, what’s worse, this person was a woman.

Hoping for support from our fellow women

This woman was also very career-focused, with impressive work experience, yet sadly someone who would never be an advocate for me as a single, working mom. Not in that moment, and not at any time after.

That's too bad because, as mothers, we hope and expect that our fellow women will embrace and uplift us -- especially when we're simultaneously juggling two jobs, as full-time worker and full-time single parent. Unfortunately, that wasn’t the case with this boss and still isn’t the case for so many women today.

Related: Coaching and Parenting Have Similar Goals But It's a Big Mistake to Do Them the Same Way

The lesson I took from that experience is that the battle for support, acknowledgment and understanding is very real, very present and not something to be expected just of our male bosses and counterparts.

Thankfully, I’ve never been the type to let these kinds of experiences weigh me down. I retain them as important lessons but don’t allow them to color my attitude or steal my joy. While I’ve encountered my share of naysayers, I’m fortunate to have been supported and uplifted by a great many men and women throughout my life. I wish the same kind of support, resilience and optimism for every one of the 10 million single working mothers in the United States today.

That’s not to say we don’t have every right to feel drained by the demands of our dual responsibilities. After all, recent studies have shown that we single working moms are putting in approximately 100 hours of labor every week, between work and home. But I want us to take a moment to acknowledge our courage, strength and perseverance, and to find the positive in what can seem like a hopelessly exhausting situation. These four steps are a good start.

1. Know that you're not alone.

Women today comprise approximately 47 percent of the American workforce. An estimated 70 percent of American mothers with children under 18 participate in the workforce, according to the U.S. Department of Labor, and 75 percent of that group are employed full-time.

Of course, nearly all working mothers juggle “second shift” responsibilities at home -- caring for kids, managing the household, cooking, cleaning, caring for relatives, engaging with the community and more. Some of us have help from a partner, and some of us don’t. And those of us doing it all alone are often stressed to the gills in an effort to get it all right.

According to a study from Pew Research, 8 in 10 adults surveyed said that women face a lot of pressure to be an involved parent (as compared to only 56 percent who said the same about men). A 2018 study on motherhood from Welch’s found that the average working mom’s day begins at 6:23 a.m. and doesn’t stop until about 8:31 p.m.. That translates to approximately 14 hours of nonstop work and home duties. And let’s not forget: Our work doesn’t stop when the weekend comes or a holiday arrives.

2. Count your achievements.

Take out a piece of paper and make a list of what you’ve done in the last week. Start with your work tasks, the mundane as well as the noteworthy. Then start listing your household and childcare tasks. Include that third load of laundry and the second reading of a favorite bedtime story (the one in which you performed all the characters’ voices, by request).

Don’t forget the nutritious meals you prepared, the life lessons you've taught, the appropriate discipline you've doled out, the picking up of all those pesky Legos. And, finally, include everything you've done to take care of yourself and others: the skincare routine you dutifully carried out, even though it was 11 p.m. and you were dead tired; that call you placed to the aunt you haven’t spoken to in a while; your successful efforts to avoid the doughnuts in the breakroom in favor of a healthy lunch.

Then, when you’ve combed through your memories of the week to include everything you’ve done, take a step back and examine the list as an outsider looking in. Try to see the list for what it really is -- the achievements of a woman who is killing it. A real-life super hero.

3. Push for benefits for working parents.

hankfully, a growing number of businesses are waking up to the workplace needs of single working moms. Smart companies are expanding their benefits and culture to accommodate parents' unique challenges, and reaping tangible benefits (including better employee engagement and lower turnover, as seen at Google). Then there are companies, like Nike and Patagonia, which offer onsite child care for employees -- a major draw for single mothers and parents overall.

Smaller companies can't necessarily afford on-site daycare but some of the things they might consider are:

- Breastfeeding rooms/storage

- Flextime options

- Paid maternity leave/adoption leave

- Back-up child care

Moms (and dads) should push for these benefits and offer positive feedback to their employers when they get them. Having a safe place to leave your child on those federal holidays that many companies don't offer, for example, can be a major stress reliever.

4. Celebrate yourself.

For all that you did this week, and all that you do throughout life, you deserve more than just a pat on the back. Frankly, you deserve a deep-tissue massage, a bottle of rosé and an uninterrupted Netflix binge. But if those things aren't possible today, just take a moment and seriously acknowledge your efforts.

Related: These 4 Startups Are Taking The Pain Out Of Parenting

Don’t let the critical voices -- whether outside or inside -- bring you down. You may not be doing everything you’d ideally like to do, you may be tired every day, and you may sometimes feel like you’re failing. But I’m here to tell you that I see your achievements and your sacrifices, and many others do, too. To the single working mother discouraged by the lack of support at her workplace, or the mom who is desperately reaching for a helping hand, I say: You are more powerful than you can even imagine. And you’re demonstrating your awe-inspiring power every single day.

Friday 22 May 2020

Adodo Consultancy Services Limited

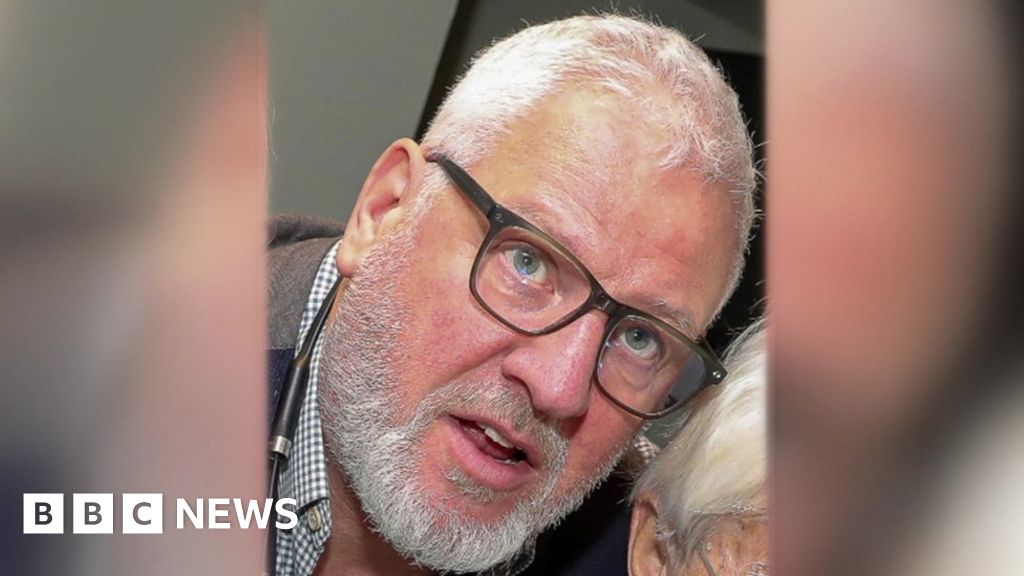

The founder and chief executive of fashion chain Ted Baker, Ray Kelvin, has resigned following allegations of misconduct, including "forced hugging".

Mr Kelvin had been on a voluntary leave of absence since December last year following the misconduct allegations.

These, which Mr Kelvin denies, are being investigated by the company.

In a statement, Mr Kelvin said the company had been his "life and soul" but "the right thing to do is to step away from Ted".

He said the past few months had been "deeply distressing" but he would support the team wherever he could offer "helpful advice".

Mr Kelvin, who owns 35% of the company, will not receive any severance pay, and any bonus payments he has earned for the past three years' performance will lapse.

In December, employees launched an online petition accusing him of inappropriate comments and behaviour.

The petition, on the workplace website Organise, said that more than 200 Ted Baker staff were finally breaking their silence after at least "50 recorded incidents of harassment" at the fashion group.

Staff claimed that as well as engaging them in unwelcome embraces, the brand's founder had asked young female members of staff to sit on his knee, cuddle him or let him massage their ears.

At the time, Mr Kelvin said that it was "only right" that Ted Baker's committee and board should investigate.

Mr Kelvin founded Ted Baker in 1988. It now has around 500 outlets in the UK and overseas.

Who is Ted Baker's Ray Kelvin?

- Born in 1955 in north London

- Started work in uncle's shop aged 11

- Founded first store in Glasgow in 1988

- Expanded to Manchester and Nottingham, then to London in 1990

- Married twice

- Awarded CBE in 2011

Moving forward

Ted Baker's acting chief executive Lindsay Page will continue in the role and the board has asked David Bernstein to act as executive chairman to provide additional support.

Mr Bernstein has indicated that he will continue in this position until no later than 30 November 2020, by which time a successor will be appointed.

In a statement, Mr Bernstein said: "As founder and CEO, we are grateful for his [Ray Kelvin's] tireless energy and vision.

"However, in light of the allegations made against him, Ray has decided that it is in the best interests of the company for him to resign so that the business can move forward under new leadership."

Mr Kelvin's statement said: "Difficult though this decision is given that Ted Baker has been my life and soul for over 30 years, I've decided that the right thing to do is to step away from Ted and allow the business to focus on being the outstanding brand it is so it can face 2019 with fresh energy and renewed spirit.

"As a shareholder in the business I'll support Lindsay in his leadership and be available to him and the team wherever I can offer helpful advice.

"I'm extremely proud of what we've achieved in building Ted Baker to the global brand it is today. Thank you to every single colleague, customer, supplier, and investor for your commitment to the business. We couldn't have done it without you and I'm so grateful.

Stockbrokers Liberum said Mr Kelvin's resignation was helpful to the company, describing his departure as "unfortunate but understandable". It added there would be minimal disruption to the business, which had "a strong team".

Shares in Ted Baker fell 4% when trading began on Monday, but quickly rebounded.

The company's shares had fallen sharply last week after it issued a profit warning, which it said was due to currency movements, product costs and a writedown on unsold stock.

It said full-year profit for the year to 26 January would be about £63m, compared with forecasts of £73.8m.

The firm's shares were also hit late last year by the hugging controversy.

Are you a current or former Ted Baker employee? Share your experiences by emailing haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also contact us in the following ways:

- WhatsApp: +44 7555 173285

- Tweet: @BBC_HaveYourSay

- Send pictures/video to yourpics@bbc.co.uk

- Upload your pictures / video here

- Text an SMS or MMS to 61124 or +44 7624 800 100

- Please read our terms of use and privacy policy

Adodo Consultancy Services Limited

It's FRIDAY! Wishing you a bright and cheery weekend! What colorful plans do you have on the schedule? Share below! #weekend #colorful #happyfriday

Thursday 21 May 2020

Adodo Consultancy Services Limited

"You don't have to be great to start, but you have to start to be great." - Zig Ziglar

Adodo Consultancy Services Limited

Is your GMB listing working for you or against you? Let's discuss https://clik.site/consult15/

Wednesday 20 May 2020

Adodo Consultancy Services Limited

Engineering Business, Case By Case

I’m an engineer, by background, so at the core I’m inspired by helping people build new things. Even though I now work primarily with large bankers I still haven’t given up my engineering mindset.

Working with large investors and vendors of technology I’ve seen up close how they analyze new technologies hoping to break into the enterprise system as new vendors or as business opportunities.

The hard truth is that 99% of vendor spend by these companies is going to enterprise providers who are already in the system!

It’s much easier and less risky to renew a five year contract than it is to take a chance on an unproven newcomer.

However, this created a situation where less new technologies were being developed, and that’s where I came in as a business analyst.

I worked as a go between for new technologies and CTOs. I work with both sides to showcase technologies and the business cases behind them. The hope is to give more start ups a chance and to improve the standard of technology across the board.

As a close observer of this process, here’s the best advice I can offer to small businesses and new companies working to break in.

[embedded content]

Pitfalls To Avoid When Starting Out

One of the attributes I need to test for with young companies is to see if they are on the right track, and if their development process is working towards a product that’s going to be a fit with enterprise businesses.

A critical component here is what their advisory board looks like and if they are venture backed or not. These board members should have strong relationships already in place in the enterprise world.

If you’re not venture backed then you need to be on the look for these individuals within the technology network you’re a part of.

For example, if you are focusing on Health Care then you want the makeup of your advisory board to have enough expertise and relationship capital to get you those key meetings as your product develops. This needs to be done early on so the track record has had time to grow.

Don’t Try To Sell Too Early

A lot of companies want to jump into a sales cycle as early as possible. I strongly caution against this – don’t try to mimic the large vendors!

What typically happens here is that companies will spend hundreds of thousands, even millions of dollars, of their capital into recruiting seasoned sales people from places like Cisco or IBM.

These folks actually have no idea how to make sales for small start ups! They’re used to the style and treatment big vendors have already earned. This can mess up everything from your cash flow to your marketability.

Strategizing For A Quick Win

Before you go and build a demo, it helps to do some thought experiment style strategizing on what’s going on within your target enterprises. This is why you need board members on your side who can lend their expertise.

If there’s leadership within an enterprise that’s trying to make a dramatic change, then they’re looking for immediate quick wins. They’re looking at the next quarter, not the next five years.

If you’re going to come in with a demo or test solution for them, then figuring out how you can make them look good before their next internal review is going to go a long way. Again, this is where relationships come into play.

It’s imperative that your point of contact with the company has the ability to say yes and sign the check. If not you need to get those relationships in place first.

Once that’s taken care of, build the demo that will give this person the success they’re looking for and you’ll be on your way.

Action Steps

- Build an advisory board of experts with experience in your target segments of the enterprise world.

- Don’t waste funds on hiring salespeople who don’t understand small start up sales.

- Leverage your relationships to understand the biggest problems facing your target enterprise customers.

- Produce a demo that solves one of their biggest immediate challenges and produces a big win for them.

- Ensure your contacts have the power to sign off financially.

Result You Will Achieve

Insight into the business practices of enterprises and how to position yourself to join their system as a startup company.

<img src="https://entrepreneurshq.com/wp-content/uploads/2018/04/LSS-Manoj-Govindan.jpg">

<img src="https://entrepreneurshq.com/wp-content/uploads/2018/04/LSS-Manoj-Govindan.jpg">Mentor: Manoj Govindan

VP – Corporate Development of Levvel IO. Manoj has helped 100s of young VC-backed tech startups navigate and scale enterprise.

This article is based on an EHQ interview with the mentor.

Adodo Consultancy Services Limited

'The rich are different from you and me,' F. Scott Fitzgerald famously said. Apparently they're different from one another, as well.

March 1, 2019 5 min read

Opinions expressed by Entrepreneur contributors are their own.

To the average person, "millionaire" and "billionaire" sound similar; they're both people with money, right? And, indeed, both have access to far more wealth than the average citizen, and neither may have to worry about money ever again.

Related: 6 Money Tips From Self-Made Billionaires

Furthermore, because entrepreneurship is often the route to wealth accumulation, both may have earned their way to riches the same way. Yet while their monikers "millionaire" and "billionaire" sound the same, there are in fact significant differences between the two.

For starters, the difference between a million versus a billion dollars is immense. To put it in context, consider that one million seconds amount to 11.5 days, while one billion total 31.5 years!. A billionaire could give his or her wealth away and make 1,000 new millionaires overnight.

Further, there are 2,200 billionaires on the planet, according to a CNBC report; and while some of these wealthy elite gained their status from a family inheritance, many of the top-ranked billionaires are entirely self-made through entrepreneurial endeavors. So, what separates these hyper-successful entrepreneurs from millionaires, who are also considered successful?

The billionaire factors

These are some of the most important factors distinguishing billionaires from millionaires:

1. Goals and commitment

First, it's important to consider the billionaire’s goals and commitments. Very few people become one accidentally; instead, billionaires tend to relentlessly pursue wealth, and refuse to compromise to achieve it. Consider the entrepreneur who grows an innovative tech startup for a few years, then gets an acquisition offer from a major tech company for, say, $15 million.

This isn’t exactly rare; Alphabet makes a dozen or more such acquisitions every year. A “typical” entrepreneur might cash out and take the $15 million as a personal victory (and early retirement). A billionaire, however, setting his or her sights higher or living out a commitment to the business's core idea, might reject the $15 million in hopes of obtaining something better, or growing the business further.

Related: Billionaires Like Warren Buffett, Jeff Bezos and Mark Cuban Live by Ancient Stoic Philosophy

Though these rejections don’t always pan out, you can’t become a billionaire by settling to be (just) a millionaire.

2. Scale

What should also be considered is the scale on which billionaires operate. If we consider profit as a product of both efficiency and impact, then the more locations your business reaches, the more money you’re going to make. Owning a chain of restaurants in one state might make you a millionaire, but you’ll need to change the world on an international scale if you want to be a billionaire.

3. Repetition

Billionaires rarely make their riches by starting just one business. In some cases, they experience a crushing failure and apply the lessons learned from that failure to future endeavors (see: Bill Gates’s Traf-o-Data). In other cases, they settle for selling a company for a few million dollars, only to roll those funds into bigger, better startup ideas (see: Elon Musk’s path through Zip2, Compaq and X.com).

They’re not only willing but eager to repeat the entrepreneurial process over and over again to achieve success.

4. Budget and self-control

There’s a reason why so many lottery winners end up losing everything. It’s because poor financial habits and decisions end up bankrupting them no matter how much money they start with (conversely, good financial habits and financial decisions can put you ahead even with a modest income).

Billionaires -- when they first reach millionaire status -- tend to avoid spending lavishly or wasting their money, which makes it easier to grow their wealth even more and retain what they’ve acquired. Some even take this practice to an extreme: Warren Buffett, for example, still lives in the Omaha, Neb., house he bought for just $30,000 in 1958.

5. Passion

You don’t become a billionaire by just "getting the job done." That level of wealth requires you to constantly come up with new ideas; adapt and refine your ideas when challenged; and put in long, hard hours throughout the entire process. While plenty of millionaires can certainly be described as passionate, their level of passion often pales in comparison to that of billionaires (think: Richard Branson, Bill Gates, Jeff Bezos, Oprah Winfrey, Meg Whitman).

Passion was always a big motivator for people like these, and kept them moving forward even after their initial success.

Related: 7 Real-Life Business Lessons You Can Learn From Billionaires

Is luck a factor?

Is luck a factor in the success of a billionaire versus a millionaire? This is a hard question to answer, and one that’s been examined in at least one scientific study. Luck is objectively hard to measure, because virtually any positive or negative development for a business might be considered good or bad luck. For example, if you beat an unknown competitor to market by just a few days, is that considered mere luck or the outcome of your tenacity?

While luck is almost certainly a factor (depending on how you define it), it isn’t the only factor, nor is it the most significant. A simple stroke of luck isn’t enough to justify a thousand-fold increase in the monetary success thousands of entrepreneurs enjoy; rather, that success is a product of these fortunate individuals' different mindsets and practices.

Tuesday 19 May 2020

Adodo Consultancy Services Limited

Sales FollowUp For Life (SFUFL), that's what we know we must do but so few actually achieve it. Marketing automation makes it so much easier. Ask us for a demo or get started here https://clik.site/sfufl/

#sfufl #marketingautomation #salesautomation #askadodo

Monday 18 May 2020

Adodo Consultancy Services Limited

“When life gives you Monday, dip it in glitter and sparkle all day” -Unknown #glitter #Monday #sparkletoday #optimistic

Adodo Consultancy Services Limited

The owner of Giraffe and Ed's Easy Diner is to close 27 restaurants putting hundreds of jobs at risk.

The brands will enter a company voluntary arrangement (CVA) and close almost a third of their 87 restaurants.

Boparan Restaurant Group (BRG) said sales had improved at the chains since they were acquired in 2016, but several sites remained unprofitable.

Tom Crowley, chief executive of BRG, said: "The CVA is the only option to protect the company."

He added: "The combination of increasing costs and over-supply of restaurants in the sector and a softening of consumer demand have all contributed to the challenges both these brands face."

The proposal to enter a CVA will be put to a creditor vote, with advisers from KPMG overseeing the insolvency process.

BRG snapped up Giraffe from Tesco in 2016, before combining it with Ed's Easy Diner, which it had bought in a pre-pack administration the same year.

The two brands form a combined entity, which in the most recently available accounts had annual turnover of £67.1m with underlying losses of £1.6m.

The company owns 70 branches of the two chains, with 17 franchised restaurants unaffected by the CVA.

Will Wright, restructuring partner at KPMG, said: "This CVA seeks to address the cost of the company's leasehold obligations across a number of unprofitable sites, and if successful, will put the business on a surer financial footing."

Creditors will vote on the proposal on 21 March with at least 75% needed to approve it for the CVA to proceed.

BRG also owns other brands, which are not involved in this CVA. These include fish and chip restaurant Harry Ramsden and the upmarket Cinnamon Collection.

It is also the master franchisee for US brand Slim Chickens, which first opened in the UK last year.

BRG is owned by "chicken king" Ranjit Boparan, who also owns the 2 Sister group, which supplies food to supermarkets such as Aldi, Asda, Co-op, KFC, Lidl, Marks & Spencer, Morrisons, Sainsbury's, Tesco and Waitrose.

Last year, rising costs and tougher competition led to several restaurant brands shutting branches, including Prezzo, Jamie's Italian, Byron, Carluccio's, Gaucho and Gourmet Burger Kitchen.

Sunday 17 May 2020

Adodo Consultancy Services Limited

Referrals aren't favors-- no need to be embarrassed! @referralsales explains how to ask for a #referral from your network: https://clik.site/referrals-jb/

Adodo Consultancy Services Limited

Have you moved to SIP Trunks? If not why not? Here are 5 reasons to act now;

• Lower monthly Line & DID Rental

• Lower call charges

• Better customer service

• Flexibility

• Move offices and keep the same number

Saturday 16 May 2020

Adodo Consultancy Services Limited

The UK will not lower food standards to secure a post-Brexit trade deal with the US, the government says.

It comes after Washington published its objectives for a US-UK trade pact.

The US wants "comprehensive market access" for its farmers' products that would see more US-made food on British supermarket shelves.

European Union rules currently limit US exports of certain food products, including chlorine-washed chicken and hormone-boosted beef.

If free of EU trade rules, the US want the UK to remove such so-called "sanitary and physiosanitary" standards on imported goods.

A Downing Street spokeswoman said: "We have always been very clear that we will not lower our food standards as part of a future trading agreement."

America's National Farmers Union has always maintained that its chicken and beef, which uses processes banned by the EU, is "perfectly safe" and argues there has been a lot of "fear-mongering".

However, its British counterpart, the National Farmers Union, said the UK government should not accept an American deal "which allows food to be imported into this country produced in ways which would be illegal here".

Amy Mount from Greener UK, an environmental lobby group, said: "This wish-list shows that a hard-Brexit pivot away from the EU in favour of the US would mean pressure to scrap important protections for our environment and food quality.

"Any future trade deals should reflect the high standards that the UK public both wants and expects."

Currency controversy

The 18-page negotiating stance from Washington also demands that the pound should not be "manipulated" to improve trade income or make UK products cheaper in the US.

US President Donald Trump has previously been outspoken about China "unfairly" using its currency to improve its trade balance - arguing that it keeps the yuan artificially low to make its goods cheaper to sell abroad.

His team has included similar demands in its trade negotiations with Japan.

Another demand from President Trump's negotiators is for the NHS to not "discriminate" against US pharmaceuticals and medical devices when purchasing goods and services.

The negotiating objectives, published by the office of US trade representative Robert Lighthizer, are only an initial move in what may be lengthy negotiations between Washington and London.

The US-UK trade relationship is currently worth £173bn annually.

Friday 15 May 2020

Adodo Consultancy Services Limited

Your weekend is only as

good as you make it! So, make it a great one! #weekend #timeoff

Thursday 14 May 2020

Adodo Consultancy Services Limited

Tweet : Why Email Is The Locomotive Of Digital Marketing via @forbes http://bit.ly/2y0BXpu

Text : Not including email in your digital marketing plan? Take a look at why email still remains at the forefront of any modern marketing campaign. http://bit.ly/2y0BXpu

Adodo Consultancy Services Limited

Facebook Stories hasn't yet become an essential element of the on-platform experience, though usage of the option is growing. Sure, Stories are growing faster on Facebook's other properties (Instagram and WhatsApp), but the company still sees Stories, in general, as the future of social interaction, and one which will eventually usurp the News Feed as the main social sharing option.

And Facebook's keen to work with that trend - whether it's an actual trend or they have to make it one.

Along that line, Facebook has now released a new set of CTA stickers for Pages, which will enable businesses to make more effective use of the option via direct response tools.

Spotted by user Ahmed Ghanem (and shared by social media expert Matt Navarra) the new buttons mirror the CTA options available in the main header of business Pages. As you can see here, you can now prompt Stories viewers to 'Shop Now', 'Get Directions' or 'Book' directly from the Stories feed.

The option will no doubt be of interest to those businesses considering how they can utilize Stories within their digital marketing process - and whether Facebook Stories is worth the effort. Is it worth the effort? That's hard to say - definitely, if the same option were released on Instagram it would be of more interest, but again, Facebook Stories usage is growing, maybe not at a comparable rate to others, but it is growing all the same.

Back in September, Facebook reported that, combined, Facebook and Messenger Stories (formerly 'Messenger Day') now see 300 million daily active users. That's not so bad - especially when you consider that Instagram Stories, which has been a big success, sees only 100 million more daily actives (400m).

The problem is that Facebook's main app has much broader scale (2.27b MAU), and as such, it's seeing far slower take-up of the option.

Consider it from this perspective - Facebook and Messenger combined now have more than 3.5 billion users, yet only 300 million of them are bothering to check their Stories each day. That's despite its prominent, top of screen placement - in fact, there's not much more Facebook can do to make Stories more present in the app. And yet, fewer than 10% of users checking them out at all. Not a great endorsement of the option.

For comparison, Snapchat has previously reported that 25% of its daily active users post to their Story every day, while on Instagram, 40% of its users engage with Stories daily. Facebook Stories is basically seeing a lot less attention, despite being in a much bigger app.

That's not to say you should ignore Facebook Stories - 300 million DAU is still significant. But it's still unclear as to how relevant the Stories option will be for Facebook users, and whether it will, as Facebook has predicted, become the dominant sharing option in its main app.

But Facebook clearly wants it to become so, and that might actually make it a great option to consider for brands. If Facebook continues to push Stories usage, through in-feed promos and other awareness efforts, that could help boost exposure for your brand Stories content, with less competition currently in the space. And with these new CTA buttons, along with links in Stories (still in testing), the benefits for business promotion may be significant.

It remains to be seen how popular Facebook Stories will become - but even right now, it's a relevant consideration for business promotion.

Wednesday 13 May 2020

Adodo Consultancy Services Limited

The chief financial officer of China's tech giant Huawei is suing Canada over her arrest at the request of the US.

Meng Wanzhou was held in December at Vancouver airport on suspicion of fraud and breaching US sanctions on Iran.

On Friday Ms Meng filed a civil claim against Canada's government, border agency and police for "serious breaches" of her civil rights.

It came on the same day that Canada officially launched Meng Wanzhou's extradition process to the US.

China has attacked Ms Meng's arrest and the extradition process as a "political incident". She denies all the charges against her.

What does Ms Meng's lawsuit say?

Ms Meng's claim - filed in British Columbia's Supreme Court on Friday - seeks damages against the Royal Canadian Mounted Police (RCMP), Canadian Border Services Agency (CBSA) and the federal government for allegedly breaching her civil rights under Canada's Charter of Rights and Freedoms.

She says CBSA officers held, searched and questioned her at the airport under false pretences before she was arrested by the RCMP.

Her detention was "unlawful" and "arbitrary", the suit says, and officers "intentionally failed to advise her of the true reasons for her detention, her right to counsel, and her right to silence".

Where are we in the extradition process?

Ms Meng, 47, will next appear in court on Wednesday, when it will be confirmed that Canada has issued a legal writ over her extradition to the US. A date for an extradition hearing will be set.

But this is still the early stages. A judge must authorise her committal for extradition and the justice minister would then decide whether to surrender her to the US.

There will be chances for appeal and some cases have dragged on for years.

Please upgrade your browser to view this content.

How did we get here?

What happened next? Show allShare this chatbot.

What is Huawei accused of?

The US alleges Huawei misled the US and a global bank about its relationship with two subsidiaries, Huawei Device USA and Skycom Tech, to conduct business with Iran.

US President Donald Trump's administration has reinstated all sanctions on Iran removed under a 2015 nuclear deal and recently imposed even stricter measures, hitting oil exports, shipping and banks.

It also alleges Huawei stole technology from T Mobile used to test smartphone durability, as well as obstructing justice and committing wire fraud.

In all, the US has laid 23 charges against the company.

Some Western nations are reviewing business with the firm over spying concerns, although Huawei has always maintained it acts independently.

How has China reacted?

Media playback is unsupported on your device

The arrest has seriously strained relations between China, and the US and Canada.

Beijing says it is an "abuse of the bilateral extradition treaty" between Canada and the US, and has expressed its "resolute opposition" and "strong dissatisfaction" with the proceedings.

China also says the accusations against Huawei, the world's second biggest smartphone maker by volume, are a "witch-hunt".

Two Canadian citizens are thought to have been detained in China in retaliation for the arrest.

China and the US are also engaged in tough trade negotiations to end a major tariff dispute.

Adodo Consultancy Services Limited

Are you using Social Media to help increase sales of your product or service? Here is a course designed to show you how to utilize social media marketing to grow your business. https://bit.ly/2XD5nut #socialmediamarketing #socialmedia #sales

Tuesday 12 May 2020

Adodo Consultancy Services Limited

"Hard work beats talent when talent doesn't work hard." - Tim Notke

Monday 11 May 2020

Adodo Consultancy Services Limited

“Happy Monday! Or as I like to think of it, pre-pre-pre-pre Friday!” -Unknown #Monday #isitfridayyet #optimistic

Sunday 10 May 2020

Adodo Consultancy Services Limited

Doing your due diligence before buying a company will earn you bargaining powerand help you avoid unforeseen problems. Here's what you need to know.

March 1, 2019 5 min read

Opinions expressed by Entrepreneur contributors are their own.

Andrew Cagnetta bought his first business -- a pasta shop in Wethersfield, Conn. -- at age 25 and quickly realized he hadn't done his homework thoroughly enough. Although he stuck to the shop's original recipes and products, customers began complaining that the recipes had changed. Sales declined, and in less than two years, Cagnetta and his cousin, the co-owner, ended up selling the store.

They had bought the shop from two elderly women who had run it for years, not realizing how integral the previous owners had been to its success. "One question I should have asked [the previous owners] was what do they think drove people to the store?" Cagnetta says.

He would never make that mistake again. 22 years later, he now owns Transworld Business Advisors in Fort Lauderdale, Fla., which helps buyers ask the right questions before buying a business. "There are no stupid questions," Cagnetta says. "The more questions you ask, the less risk there will be."

Where to begin? Here are 10 key questions to ask sellers before agreeing to buy their business.

Saturday 9 May 2020

Adodo Consultancy Services Limited

A group of Christian church investors is planning to put pressure on companies which have no women directors or a questionable record on tax.

The Church Investors Group has pension fund members with £21bn in assets.

It says it will vote against chairmen and women of boards of big companies which have poor polices on tax transparency and climate change.

It will also vote against pay reports which do not disclose the ratio of pay between top bosses and workers.

The Church Investors Group (CIG) has 67 members including the pension funds for the Church of England and the Methodist Church.

'Common good'

"Ultimately a company's license to operate depends on the confidence of the public and its long-term contribution to the common good," said Canon Edward Carter, chair of CIG.

"As asset owners, we will continue to press with our votes the need for companies to act responsibly and work not only for the benefit of shareholders, but also contribute to the wider common good in both the short and long term," he said.

CIG says it has told FTSE 350 companies - the largest companies publicly traded in London - of its plans.

It will also include Russell 50 companies - an index of the biggest US companies - when it comes to tax transparency.

Large companies will soon have their annual meetings where shareholders will be called to vote on board membership, pay for top executives and to accept annual results.

'Hard line'

The CIG says its members will vote against the chairs of FTSE 350 and Russell 50 companies with a score of zero for tax transparency in the FTSE ESG ratings, which look at environmental, social and governance matters.

Currently, that includes Exxon, Amazon and Broadcom, the Financial Times reported.

The CIG also said it wanted to "take a hard line on excessive executive remuneration" and that it "continues to have concerns about CEOs receiving pension payments that are more generous than those made to other staff".

The Church of England has a £8.3bn investment fund, which it says it invests in an "ethical and responsible way".

The Church holds investments in firms including pharmaceutical giant GlaxoSmithKline, the bank HSBC, supermarket Tesco, as well as tech firms Microsoft and Samsung.

However, it has been criticised for some of its investments.

In September, the Church said it was keeping its shares in Amazon - a day after the Archbishop of Canterbury Justin Welby said the firm was "leeching off the taxpayer".

The archbishop had questioned Amazon's tax record.

In 2014, the commissioners sold around £75,000 of shares in failed payday lender Wonga after the archbishop pledged to "put it out of business".

He had admitted to being "embarrassed" and "irritated" when details of the link emerged in 2013.

Adodo Consultancy Services Limited

Look at how entrepreneurs can boost their business using blogs, social networking sites, multimedia, and online review sites with The Business Owner's Social Media Tool Kit. https://bit.ly/3be95if #businessowner #entrepreneur #socialmedia #marketing

Friday 8 May 2020

Adodo Consultancy Services Limited

Whether your weekend is full of fun and friends or food and shows, make it a great one! #weekend #havefun #happyfriday

Thursday 7 May 2020

Adodo Consultancy Services Limited

"Nothing is impossible, the word itself says 'I'm possible'!" - Audrey Hepburn

Wednesday 6 May 2020

Adodo Consultancy Services Limited

A Micro Moment is a moment when a consumer is ripe to learn, experience, and buy things. It’s the ideal time to capture a new customer because they’re already in the right mindset to engage with your content. https://clik.site/micro-moments/

#micromoments #salesfunnel